N8N vs. Zapier vs. Relay.App & Co.: The future of AI automation

Context

In 2019 Jan Oberhauser launched N8N as a “Workflow automation alternative to Zapier” (see post on Hacker News).

Now, 6 years later they apparently managed to raise enough money to become a unicorn: As the german Handelsblatt writes (translated):

Valued at $2.4 billion, several people familiar with the negotiations told Handelsblatt. Start-ups with a valuation of more than $1 billion are considered unicorns. The financing round for n8n is expected to be completed shortly.

Back then, the space was full of competitors. As rrgggrr worte on the above-mentioned launch post:

Crowded space, but darn few (if any) shared source or community based solutions. Here's a several examples from a market study I did in 2018: Workato, Apiant, Inegromat, Snaplogic, CloudHQ, Boomi, Tibco, Jitterbit, AWS Lambda, Mulesoft, Tray.io, ApacheNiFi, Stringify, Adeptia, Kotive, Cazoomi, Scribesoft and several more.”

However, the space today is even more crowded and more faccetted:

- threat of disintermediation by native workflows. Companies like Notion are bundling workflow capabilities directly into their application

- a range of new agentic automation startups

- Zapier has not stopped innovating

- Big Tech solutions like Microsoft are coming up with Power Automate and Co.

Besides the competitive pressure, classical distribution channels are changing (think LLMs) and consumer preferences are changing. Because all of that affects us building Researchly, I dug deeper into (AI) automation tools to understand what that means for us (see end of post, the rest might be relevant to you, even if you are not working at Researchly)

N8N vs. Zapier or Zapier vs. N8N

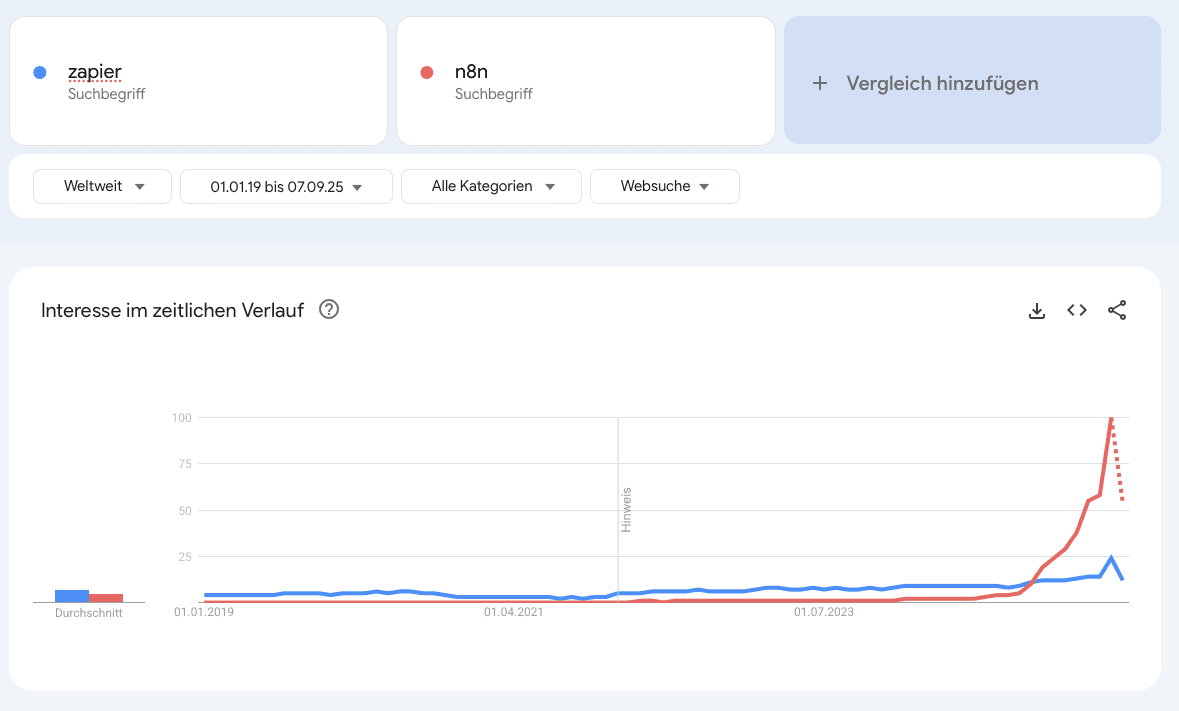

Historically, Zapier came before N8N and thus N8N established itself as David in the David vs. Goliath competition. However, if you look at the last six years, N8N grew, despite the strong competition - espeically in the last months. If you look at the Google Trends chart below, N8Ns growth basically exploded.

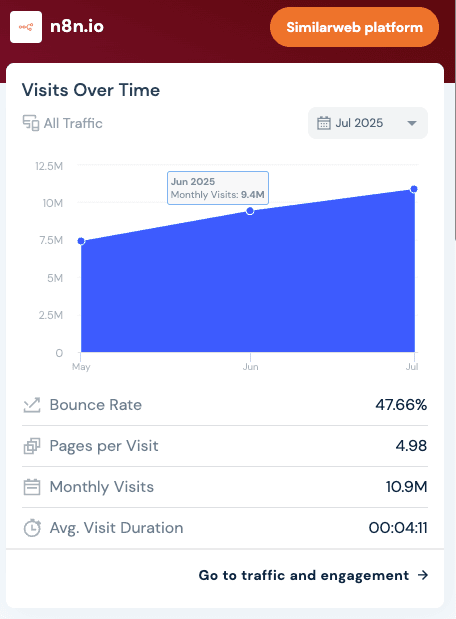

Furthermore, Zapier web traffic declined, while N8N’s grew. For that, take a look at the traffic data from Semrush:

The decline in web traffic is interesting for a couple of reasons. Firstly, Zapier basically grew based on organic traffic. As Tom Alder writes on Strategy Breakdowns:

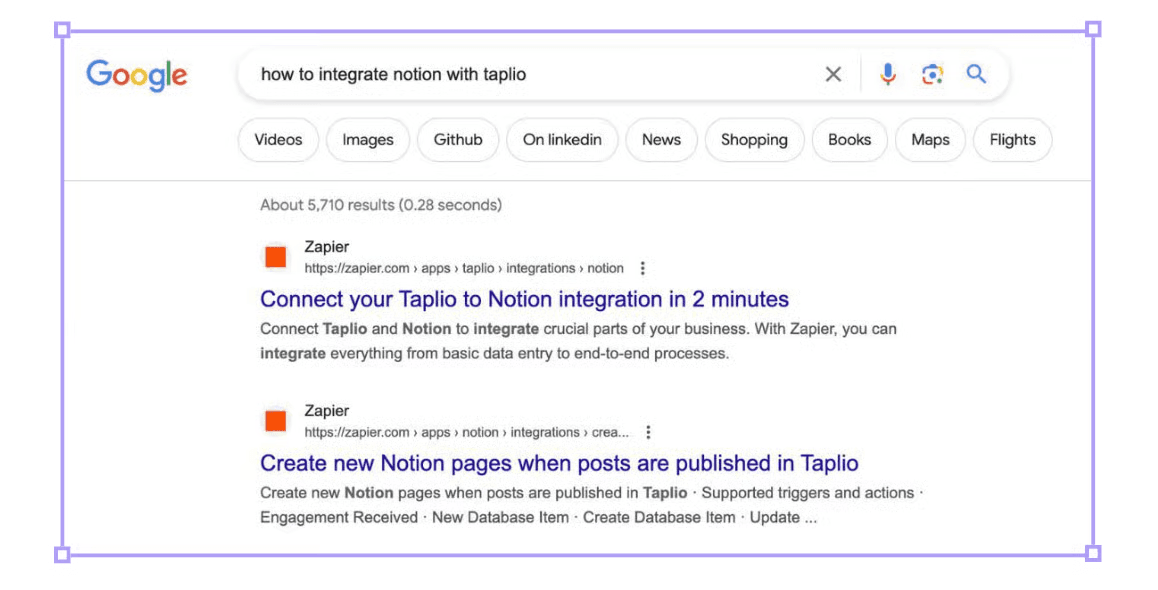

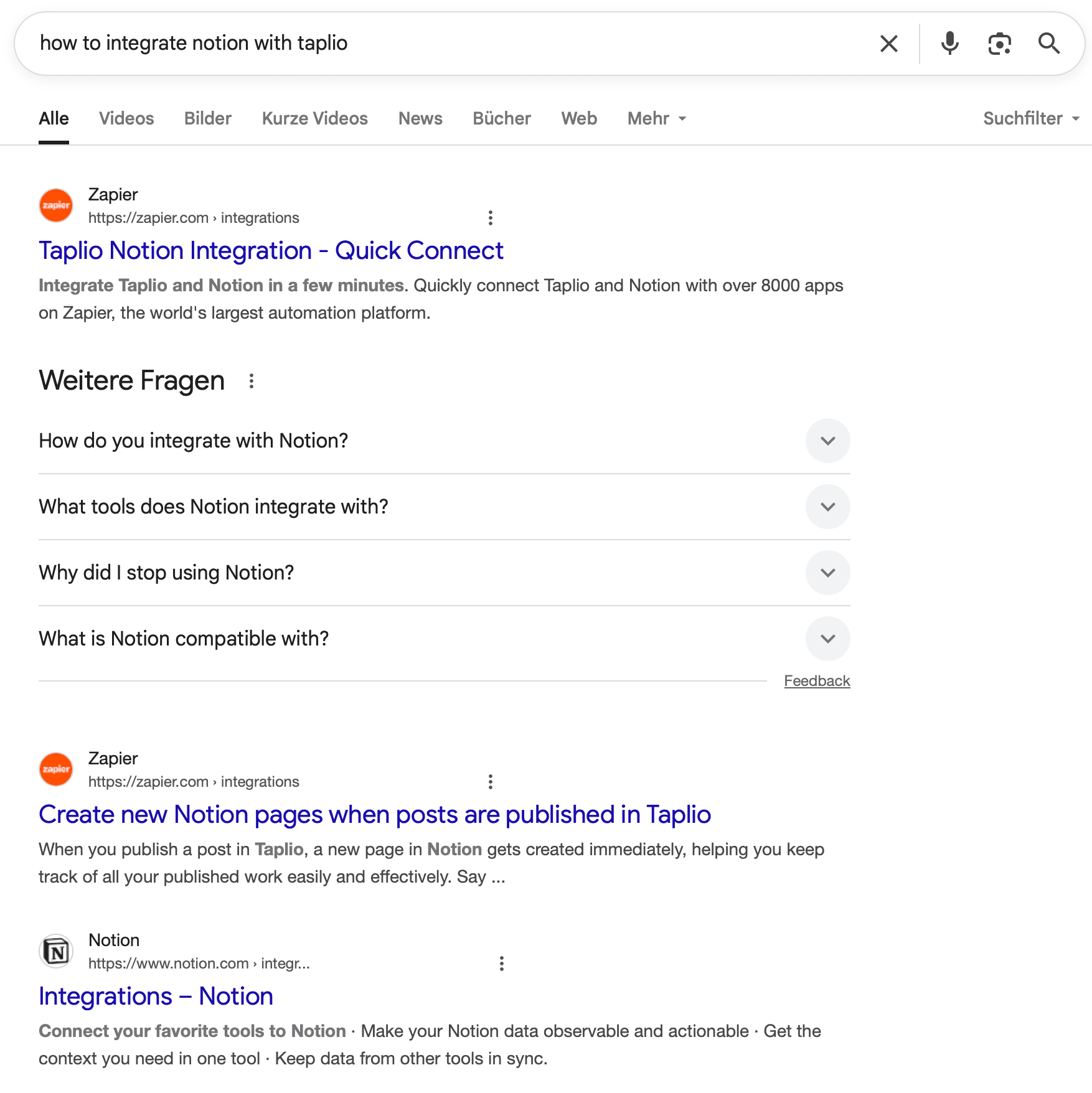

- A landing page for every use case Imagine you are a writer using Notion as a content calendar, and Taplio for LinkedIn scheduling. You want to automatically log published posts in a Notion database, to avoid manually copy-pasting each day. You search: “How to integrate Notion with Taplio” The top results - both Zapier. The 2nd link is exactly what you’re after. Click. You scan the page, sign up for free, and land directly in a ‘Zap’ configuration for your specific use case, bypassing any central dashboard or onboarding friction.

Secondly, the question is why their traffic is declining. This might be Google's fault.

Why is Zapier's web traffic declining: Google's AI Overview

As I have explained in SaaS Stocks and AI’s Disruption: Monday.com, Salesforce, Gartner & Beyond and Semrush: Alleged layoffs, and is AEO a feature or a company? SaaS startups are losing low-end consumers due to Google AI overview:

Here’s Monday.com — taken from their earnings calls transcript: Upmarket, we have record net adds for the 100,000 customers … we are seeing some softness within the down market due to the changes in the Google algorithm. But this is temporary, we believe, and we are already taking actions proactively to address this, and we believe this is going to be recovered going into the second half of the year.

So, the web traffic decline might be temporary and only to high-churning consumers with low CTV. However, if that is the case, two questions remain: Why didn't N8N traffic decline?

Why N8N's traffic grew

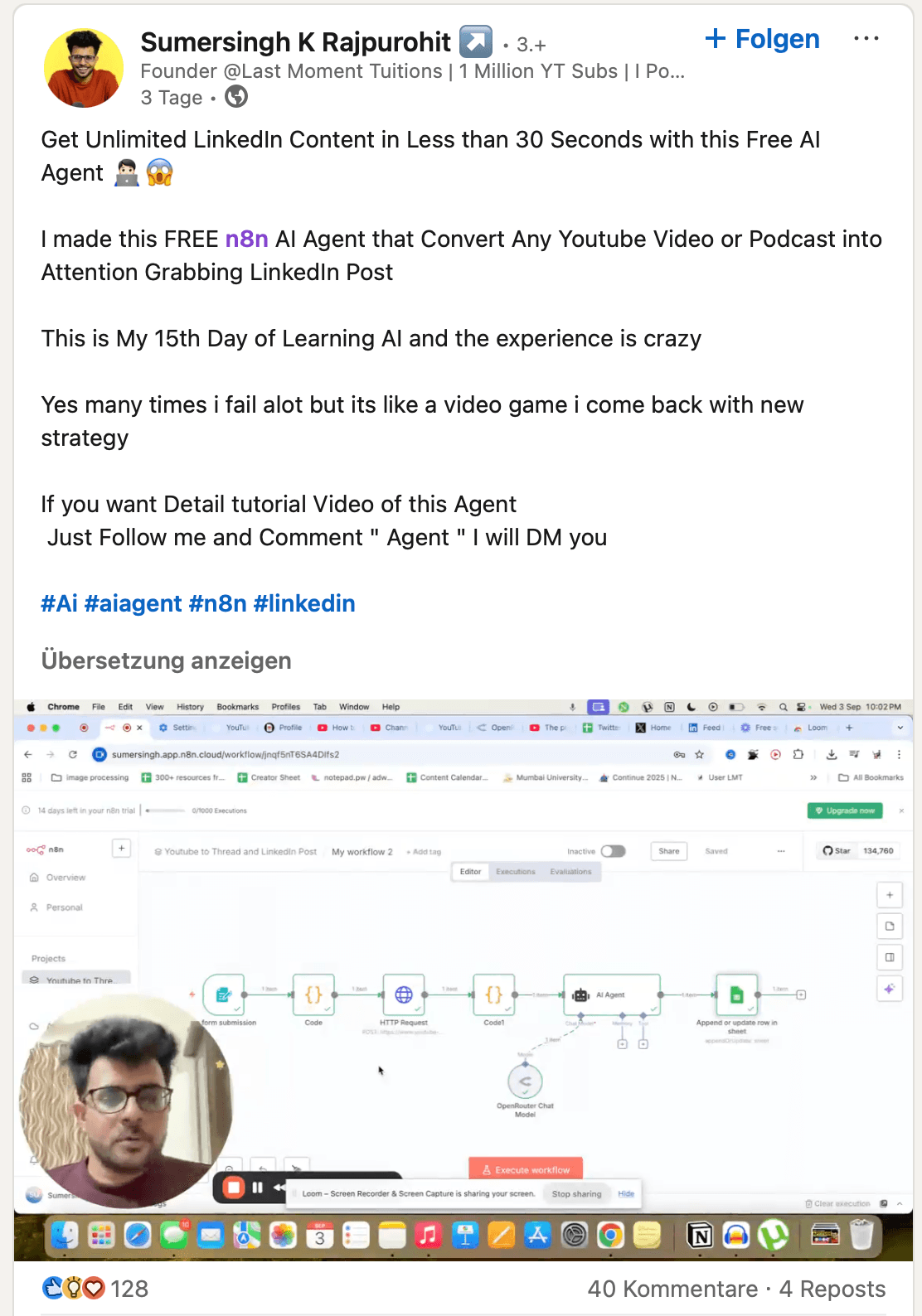

N8N’s largest growth channel is LinkedIn. As you can see from the screenshot below, LinkedIn is full of people sharing N8N workflows Although I do not have any data for that, coupled with N8N's affiliate program, it sounds plausible.

The screenshot was taken randomly after searching for "n8n agents comment" on LinkedIn.

That’s a great growth channel, because both sides profit:

- N8N get’s users

- the users grow on LinkedIn

- Ideally, the LinkedIn-users earn through N8N affiliate program

LinkedIn as a growth channel makes no sense

To me, it makes no sense that N8N grew so strongly on LinkedIn.

Zapier grew because they were focusing on ease-of-use for busienss users:

While more robust integration platforms exist, like Mulesoft, Workato, and Tray, Zapier focuses on ease-of-use for the long-tail of prosumers.

N8N on the other hand, launched as a tool for developers and are still positioning themselves as a "Flexible AI workflow automation for technical teams" on their website.

Is N8N seeing its "Lovable"-moment

In Figma's Death: Innovator’s dilemma, AI moats & Vibe Coding I took a look at Figma vs. Lovable and concluded that they are not in direct competition becuase they are targeting different personas:

And that’s the major part where Figma and Lovable differs: you use Figma if you are a professional, collaborative designer, and Lovable if you a solopreneur designing an MVP.

I think something similar is happening with N8N. Their AI Agent node has made making automations so simple that even non-technical users can build automations.

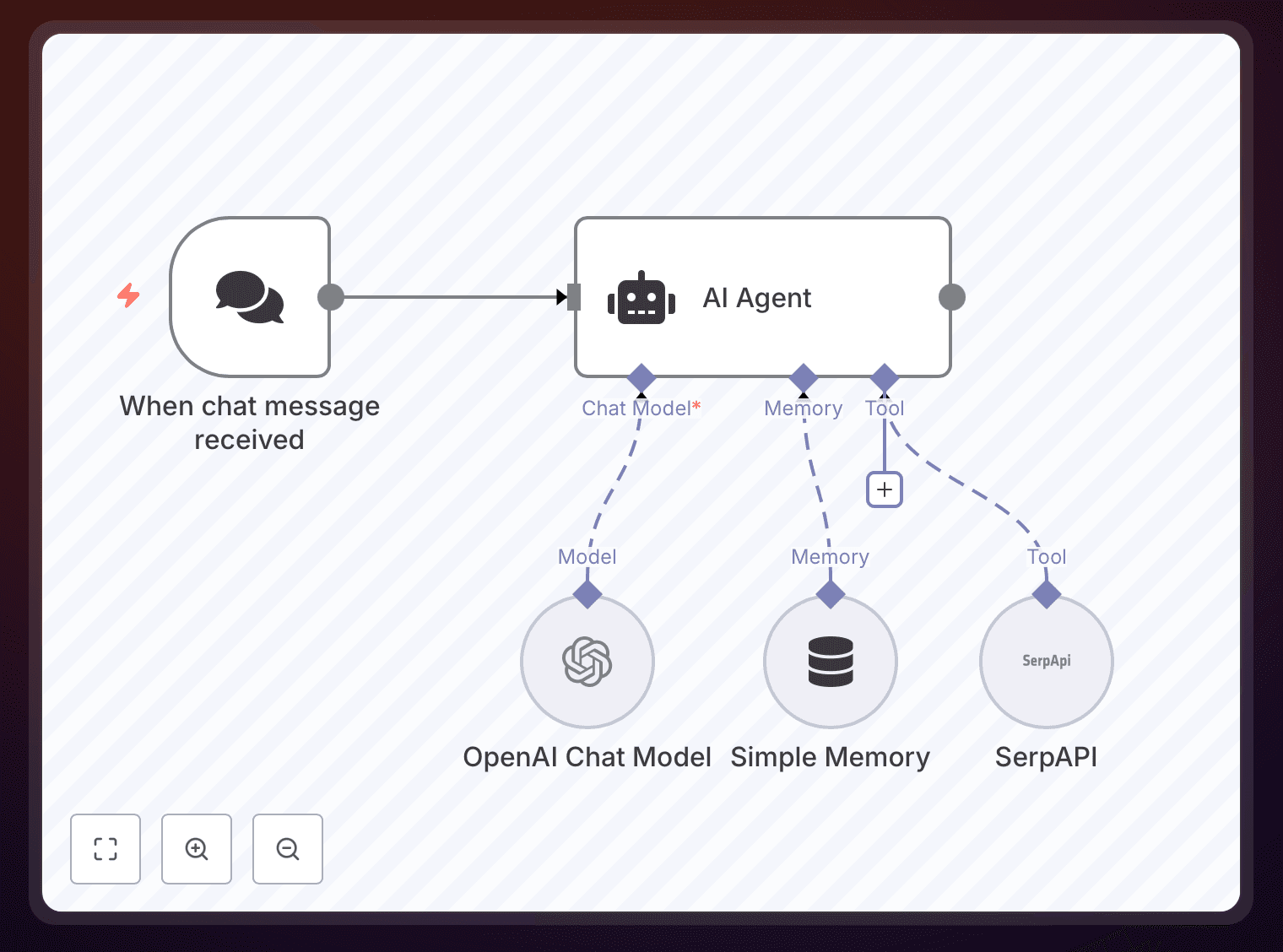

You can think of that node as a piece of software that works like ChatGPT but is connected to various tools. So you can have a simple setup saying: "take the chat message and try to answer it via google (serpAPI), our database or by asking ChatGPT" (see screenshot).

In short, if you can build agents in ChatGPT, you can build N8N workflows.

Uno-reverse: while N8N is betting on no-code, Zapier is moving towards coding

I think that Zapier is very aware of the shifts in user expecations. As a consequence, they are also changing their target customers. However, I am not 100 % sure who it is. Take a look at their current product portfolio:

Fully functional:

- zaps (the automation)

- tables (automate data workflows)

- interfaces (no-code way to build front-ends)

In Beta

- Canvas (build workflows using natural language)

- Chatbots

- Agents

- Functions (automation using code)

- MCP

According to Contrary, Google Sheets is one of Zapier's most most used integration. As such, they want to keep as much data as possible in the tool. With interfaces it’s getting a little bit murkier because there are multiple alternatives; you can use any number of no-code apps and then build the backend-end any kind of automation tools. At this point, they are basically building Airtable.

The beta functions are where it gets even more confusing for me, specifically with Functions, Agents, and Chatbots. Functions goes directly against their no-code mission. And with Chatbots and Agents I am unsure why they need to have two such features in beta. I think they would have a better competitive positioning if they made their agents great and neglected everything else. Maybe there's a large market of buyers who need that combination, but I think that a "best-of-breed" makes more sense here, especially given the interestg around AI agents.

Making things more complicated: MCP, bundling and agentic automation startups

So, while N8N and Zapier are battling against each other a bunch of new solutions are entering the market:

Threat of disintermediation by native workflows

As Contrary wrote in 2023, Zapier is pressured by horizontal integration

that is only compounded by the threat of disintermediation by native integrations. Companies like Calendly bundling workflow integrations into their product could move a significant number of potential Zapier users looking for Calendly integrations away from using a third-party integrations tool.

The same is even more true today. Companies like Notion are bundling workflow capabilities directly into their application. That is not just a theoretical threat but a very practical one.

Consider the example from Strategybreakdowns:

Today, Zapier is still among the first two results. However, followed by Notion:

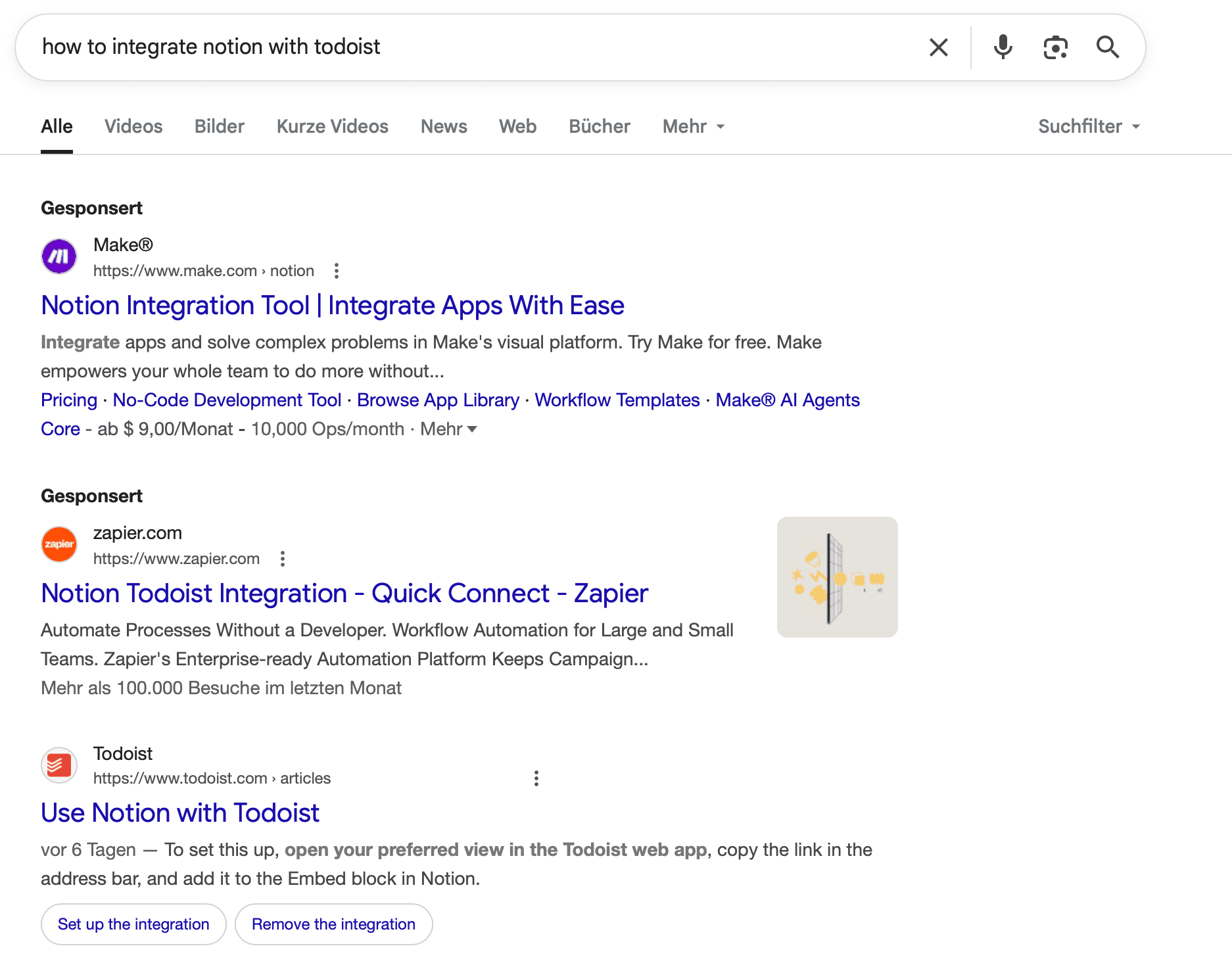

If you look at another example, it looks quite different:

So, native competition is a growing threat. And I think that this threat is going to increase. Because, “owning the workflow” is one of the major tactics startups follow.

My takeaways

- LinkedIn can be a great growth channel

- Community and "open-source" can outpace commercial

- Disruption happens slow, then suddenly

- Consumer preferences can change quickly

- What is your wedge? Where do you start and how far do you epxand

- You can be a Jack of all trades and master of all

- Define your "node". Zapier's main node was Google Sheet, N8N's main node are AI Agents. A similar advice is to find a document (like an investing memo or due diligence report) and work towards automating that "piece of paper"