Figma's Death: Innovator’s dilemma, AI moats & Vibe Coding

At Researchly I spend a lot of time thinking about moats in AI statups. With Figma's IPO, they company is a great way to reflect on that - hoping to get some feedback on my thinking along the way via e-mail or LinkedIn.

The death of Figma and UI according to LinkedIn

If you look around the web (especially LinkedIn) you’ll see an endless stream of posts claiming the death of Figma (post 1, post 2). The arguments are nuanced and go from “almost dead” to “absolutely dead”.

Even more, there’s an equal amount of posts proclaiming the death of UX / UI as we know it - due to AI. A recent post - which I came across by accident - is titled AI Is Flipping UX Upside Down: How to Keep Your UX Job, and Why Figma is a Titanic (It’s not for the Reasons You Think). Although I think that the author did a poor job defining UI / UX, the post is representaive for the overall sentimnt: UI / UX is dead, and Figma being the UI tool, is dead as a consequence.

Why is AI Figmas killer?

(If you are already familiar with Vibe Coding, this segment is irrelevant to you.)

(If you are already familiar with Vibe Coding, this segment is irrelevant to you.)

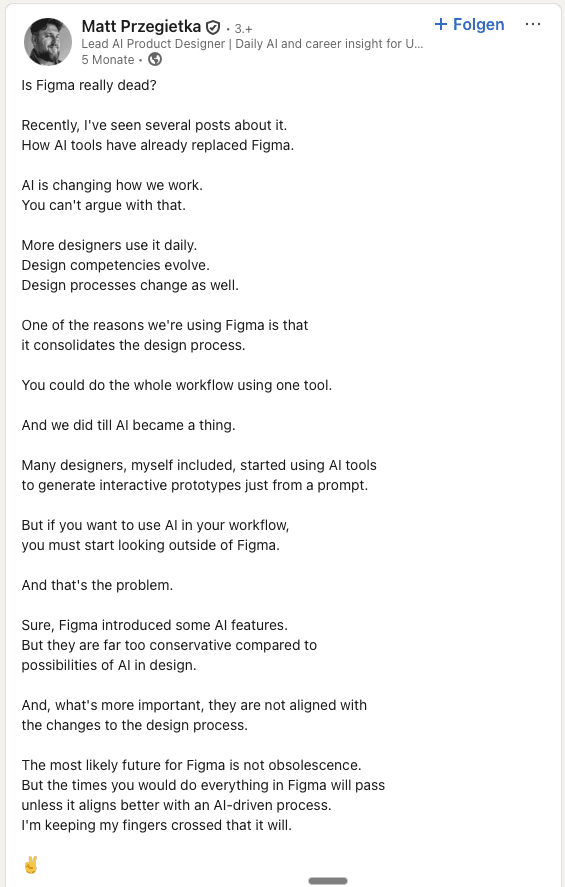

The reason why Figma is proclaimed dead can be boiled down to Vibe Coding tools such as Lovable or Cursor (There are also less well-known tools with a stronger focus on UX generation such as UXPin or Magicpatterns but throughout the text I'll use Lovable as a representative example). With a simple prompt these design pixel-perfect, clickable UIs. At the first, that makes a lot of sense. From my personal experience: I have tried using Figma multiple times, but the learning curve was simple too steep for me. With Lovable I can do exactly what I want with the skills I already have. But does this mean, that Figma is dead?

There’s a few things to unpack here. So let's dive in.

What exactly is Figma

Before trying to understand if "AI" can kill Figma, it's good to understand what Figma is.

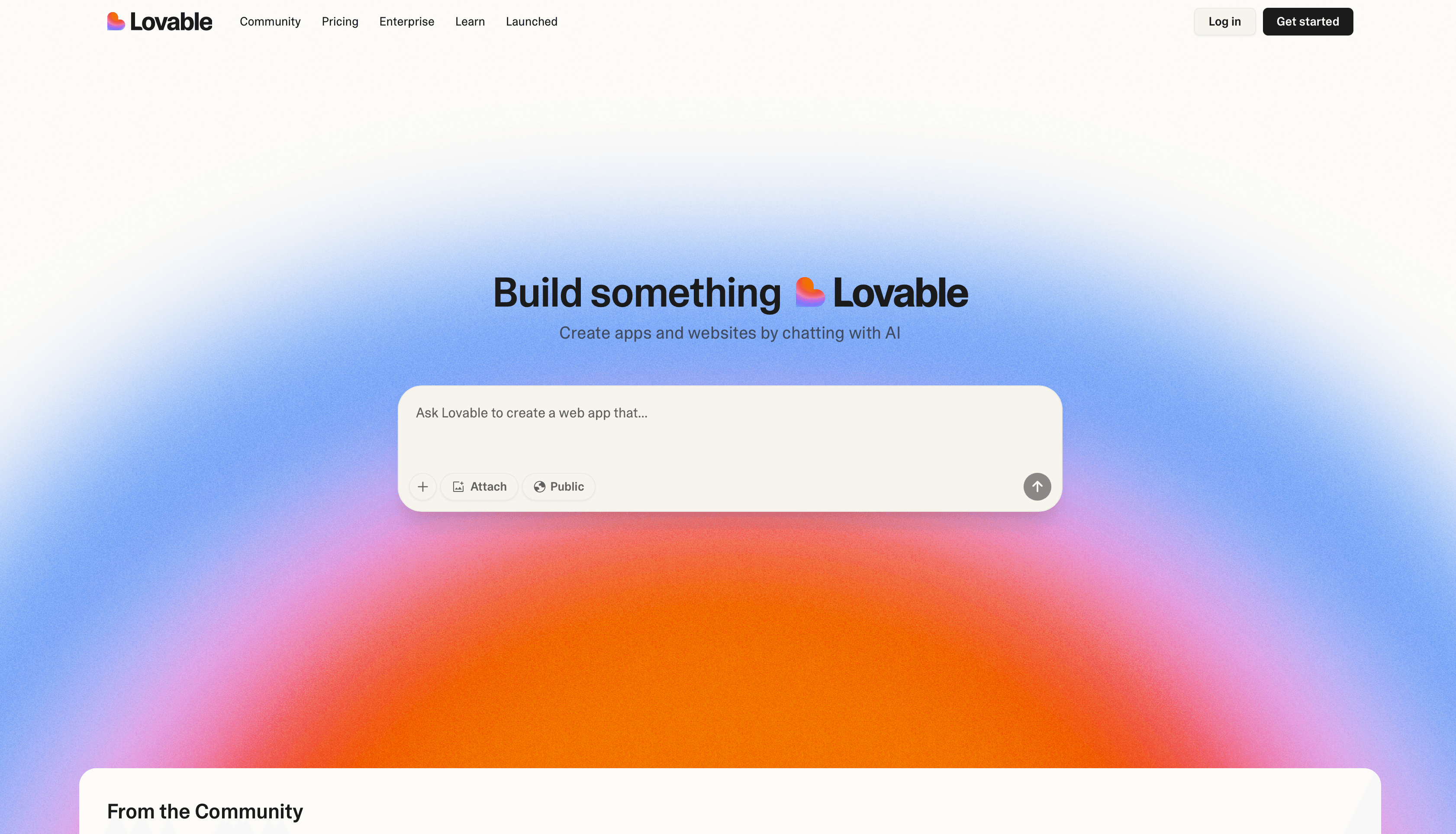

First, Figma is more than just design. They offer multiple tools including Figma Design (the original tool), Dev Mode for “design to code”, a digital whiteboard, a slide tool, and a few beta products like Figma Draw. In this post, I’ll focus solely their main tool Figma Design as it is the major point of attack.

Before trying to understand if "AI" can kill Figma, it's good to understand what Figma is.

First, Figma is more than just design. They offer multiple tools including Figma Design (the original tool), Dev Mode for “design to code”, a digital whiteboard, a slide tool, and a few beta products like Figma Draw. In this post, I’ll focus solely their main tool Figma Design as it is the major point of attack.

How to assess Figma: 7 Powers

With that focus on Figma's Figma Design, I like to first assess how "good" a company is. This helps me better understand what an upstart is against, when it comes to replacing.

Hamiltons 7 Powers provide a good framework for evaluating Figma. The powers include scale economies, network effects , counter-positioning, switching costs, branding, cornered resources, and process power.

Based on that, Figma has a lot of power:

They have strong network effects, with their template gallary, integrations into dev and publishing tools, and an API. The brand is also well-known, trusted, and has a large community.

However, what I think makes them particularly powerful are their switching costs.

Figma: Source of truth as major competitive advantage

For the major part of my professional career, I have worked as a Data Scientist trying to build Data Warehouses. Data Warehouses are represents a company single point of truth (SPOT) when it comes to data. Such systems are terribly hard to build. However, once setup, they are almost impossible to rip out because they not only capture the data but also shape a company’s workflows. SAP, Jira, Atlassian (Confluence) are prime examples of that. As Ben Thompson points out on Stratechery (paywalled) that’s what makes Figma so great strategically:

This is where my previous labeling of Figma as the OS of design was so important: what OS’s have is coordination and orchestration capabilities, they are the one canvas on which all work happens, and they are the ultimate source of truth of everything that is happening. Owning an OS will, in my estimation, be the most important factor in building AI agents that actually work, and Figma owns one.

As a side note: There are multiple companies trying to build an "OS". As I have pointed out in 2025 ZM (ZOOM) Q2 Earnings Call Analysis Zoom is trying to build a "workspace OS", Miro is trying something similar etc. pp. All those new OSs raise the question which one will eventually prevail and how many we realistically can have. But that's beyond the scope of this post.

Vibe Coding / Designing: What makes them so great?

To better assess the competitive forces, it helps to understand what makes Loveable and Co. great. I think that Hamiltons 7 Powers again provides a good explanation here, concretely counter-positioning. Hamilton defines counter-positioning as something that a startup does differently to an incumbent. And the incumbent cannot copy that because it will affect its bottom line or because they simply cannot do it (that’s basically a different term for the innovator’s dilemma).

Counter positioning was what helped Figma become great. Again, from Stratechery:

However, while Adobe successfully changed their business model, the product really wasn’t that different. Oh sure, there were new features, and a new option to save and sync your files to Adobe’s cloud, but the fundamental concept of standalone apps working on files remained; teams would have to go elsewhere to figure out how to collaborate and, thanks to Adobe’s dominance, they would drag Creative Cloud along with them. Still, this left an opening for new web-based apps like Figma to start nibbling away at Adobe’s dominance: when working on things like UI design, collaboration is paramount, making the limitations of the web well worth whatever sacrifice in performance was entailed. Adobe was, in other words, being disrupted: new technologies were enabling new vectors of competition that Adobe, focused on providing ever more powerful features on its vector of dominance for its best customers, couldn’t or wouldn’t respond to.

Lovable has - like Figma when it was first launched - defined a new product category where non-developers and non-designers can now “develop” and “design” (of course with the caveats that come with vibe coding).

And that’s the major part where Figma and Lovable differs: you use Figma if you are a professional, collaborative designer, and Lovable if you a solopreneur designing an MVP.

Can Vibe Coding move up-market?

Now, from that standpoint: the people using Lovable and Co. today wouldn't have used Figma anyway. So, Vibe Coding startups are not a direct competior to Figma. However, given the nature of disruption, these opposed target markets, should be a concern as Vibe tools will eventually move up-market to add more “mature” features. And that’s what makes this dynamic so interesting. The question is (again borrowing from Stratechery):

if Adobe could add web-native features like collaboration, built-in version control, etc. faster than Figma could develop the editing and creation capabilities that might render Adobe products completely unnecessary.

Now, instead of Adobe it’s Figma and instead of collaboration is “AI-native”.

Although Loveable and Co. have great traction, as far as I am concerned, it is currently still unclear how best to build a moat around an AI application. As you can see from the latest OpenAI update (GPT5) LLMs are getting increasingly better at designing and are basically one API-integration away.

So to sum up:

- Vibe Coding tools are targeting a different market

- Vibe Coding is one API away

- As the failed Figma acquisition shows, building Figma is not easy.

Can Figma move down-market?

Looking back at all the powers outlined above and the improvements in LLMs I do not see how Figma is dead or will be killed. They might, however, be stuck in the cited innovator’s dilemma. They just need to find a way to serve the “solopreneur designing an MVP”. That is obviously super hard to do, but I think it is harder to replicate what Figma has already built. Especially, as Figma has the cash (or will have through their IPO) to basically just buy one of these Vibe Coding tools. That is what Wix did when they bought “6-month-old, solo-owned vibe coder Base44” for “$80M cash” and I think Zoom is going to do as well:

Competition based on price What struck me the most, was that there are indications that Zoom is fighting a "pricing war" in the unified communications market . RingCentral's new $5/month phone service was specifically called out on the earnings call (from an analyst), but Zoom’s leadership dismissed it as unlikely to succeed against their proven, scalable stack. I thought their communications products so good that a price war was irrelevant. Even if Zoom does not see it that way RingCentral apparently does.

Zoom’s Next Bets: "Aggressive" M&A

How is Zoom responding? The Q2 earnings call provided some clues. CEO Eric Yuan emphasized several things. Including, of course, AI. But more interesting to me was the indication regarding M&A. Notably, Yuan was candid on the earnings call

We cannot build everything organically, even if we want to... In the AI era, you have to move faster. I think in my view, there are a lot of M&A opportunities down the road. That’s kind of our strategy.” This openness to acquiring new capabilities signals Zoom’s intention to quickly fill feature gaps and respond to customer demands—even those emerging from AI-first startups and vertical challengers. Maybe I am reading into things, but I think that the recent IPOs moves / rumors around Figma, DeepL and Canva are all aligning their fundraising and product roadmaps to defend against, or integrate with, upstart competitors leveraging AI.

My takeaways

- claiming that AI will kill a company is getting boring: an incumbent can use that AI as easily

- for incumbents AI is more a business question (pricing, distribution etc.) than a technical question

- for startups AI is a technical question as well as a business question (distribution etc.)

- AI enables startups to literally disrupt incumbents (as defined in the original, academic way)