2025 ZM (ZOOM) Q2 Earnings Call Analysis

2025 ZM (ZOOM) Q2 Earnings Call Analysis

Last week Zoom held their Q2 2025 earnings calls.

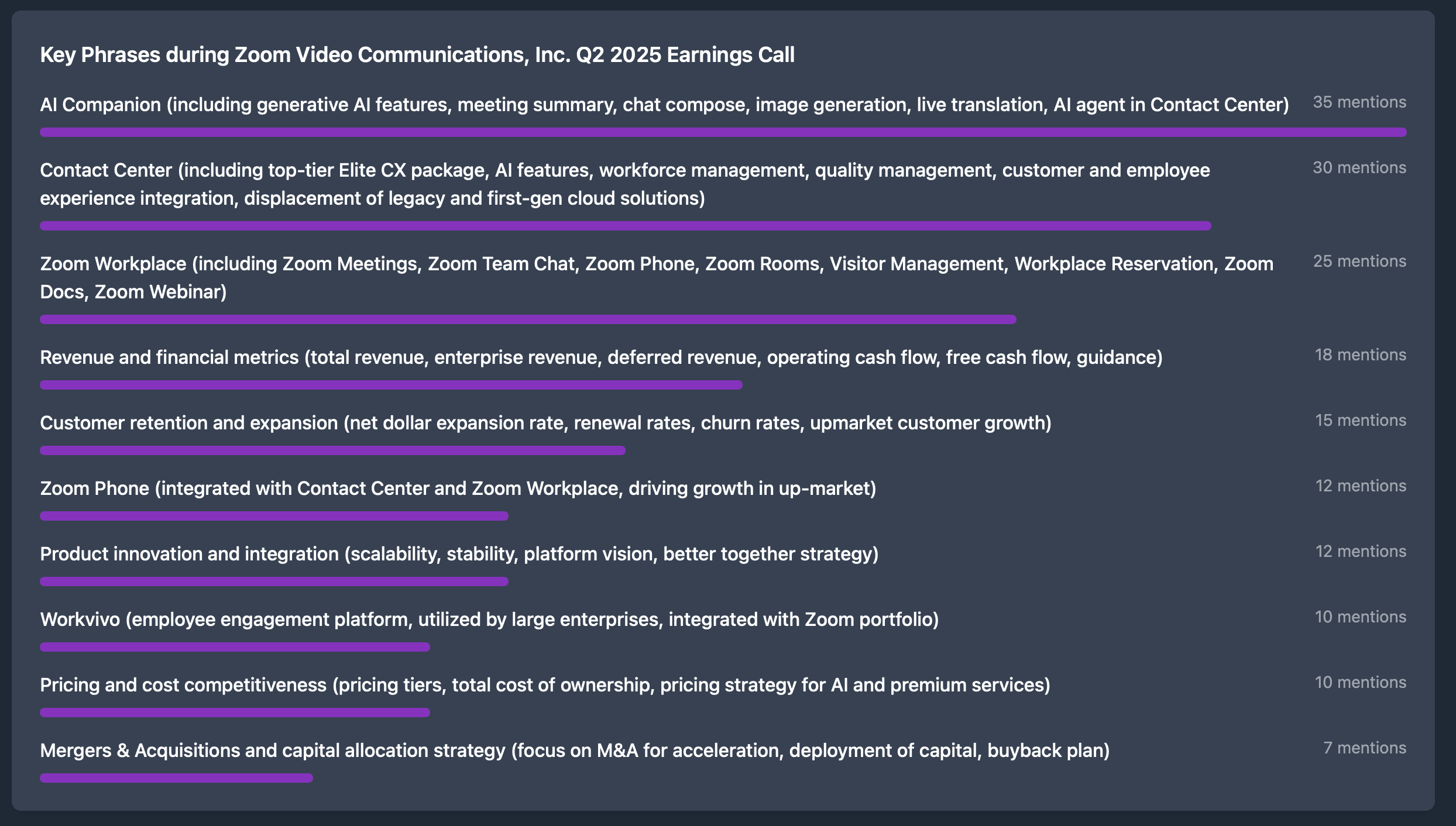

Besides during Covid, I have never really used Zoom or realized that they exist. I knew that they are more than just meetings, but I was honestly surprised how much more they are (or want to be). As you can see from the major themes during the call (see screenshot) they are an "AI-first productivity platform" resembling more Miro/Slack than a meeting tool:

- Zoom Workplace now brings together Meetings, Team Chat, Phone, Calendar, Mail, and the newly launched Zoom Docs.

- Its AI Companion integrates third-party apps to automate workflows, summarize documents etc.

- Contact Center

What is ZOOMs positioning?

As indicated above Zooms "Work OS" tactic resembles the same tactic that Google and Microsoft (and many others - there were even rumor that OpenAI would do that) are following. But what's their edge? Amongst other things, Google and MS have distribution. Zoom seems to have that as well (depending on the source they have a 56 % market share). To some extend, Google and MS made their core product (meetings) a feature of their overall platform.

Competition from all around the place

Further downstream, niche players are attacking with AI-first offerings (Otter, Firefly or Granola) for "meeting intelligence) or "agent companies" like fonio.ai targeting vertical communications use cases. Additionally, amongst startups I see a growing use of Notion. An Notion is basically working on that same tactic - building a Work OS with their recent releases such as Notion Instant Meetings (which records your meetings) or Notion Mail (which has been around for quite some time now).

Competition based on price

What struck me the most, was that there are indications that Zoom is fighting a "pricing war" in the unified communications market . RingCentral's new $5/month phone service was specifically called out on the earnings call (from an analyst), but Zoom’s leadership dismissed it as unlikely to succeed against their proven, scalable stack.

I thought their communications products so good that a price war was irrelevant. Even if Zoom does not see it that way RingCentral apparently does.

Zoom’s Next Bets: "Aggressive" M&A

How is Zoom responding? The Q2 earnings call provided some clues. CEO Eric Yuan emphasized several things. Including, of course, AI. But more interesting to me was the indication regarding M&A. Notably, Yuan was candid on the earnings call

We cannot build everything organically, even if we want to... In the AI era, you have to move faster. I think in my view, there are a lot of M&A opportunities down the road. That’s kind of our strategy.”

This openness to acquiring new capabilities signals Zoom’s intention to quickly fill feature gaps and respond to customer demands—even those emerging from AI-first startups and vertical challengers.

Maybe I am reading into things, but I think that the recent IPOs moves / rumors around Figma, DeepL and Canva are all aligning their fundraising and product roadmaps to defend against, or integrate with, upstart competitors leveraging AI.

Why did I write this

- With Researchly we are also working in AI and constantly trying to figure out how to best compete. Looking at the "big players" is a good learning ressource

- We have built a simple tool earnings call analysis too which we like using for such analysis. You can use it for free here